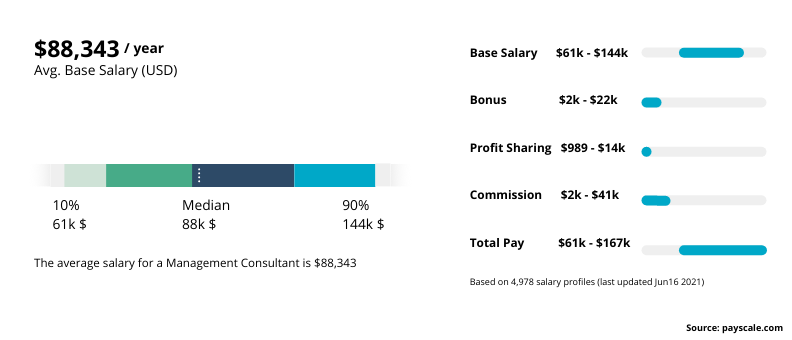

What does a Financial Consultant make? This will depend on how much experience you have, your location, and how many hours work you do. However, there are some factors that can make a difference, too. Education and geographical location are both important. It is also important to have experience. Employers will be more inclined to pay you a bonus if you reach your goals. So, how can you get a financial consultant salary? For some helpful tips, read on. Take a look at these tips before you go.

Experience

Many factors influence the salary of a financial adviser. These factors include education, experience, job location, company culture, and education. Many companies offer benefits such as pension plans and 401(k), along with flexible work hours. A financial consultant's average annual salary is $40k. However, it could be higher in larger companies. Financial consultants are expected to grow at an average rate of growth, even though many companies don’t have salary data.

The average salary for a financial consultant is Rs6,83,400 per year, or Rs37,020 per month. This is almost 76% higher than the average national salary for professionals. For financial consultants, the starting salary is approximately Rs2,31,000. However, more experienced professionals can earn more than that per year at Rs11,76,000. The salary for this job starts at $23,000 and can go up to $50,000.

Education

A Financial Consultant earns an average salary of $151,011 annually in San Francisco. It can range from $87737 to $186 045 in California. A Bachelor's Degree is the best education level for a finance consultant. The Salary Data for Financial Consultants is based on national results from ERI. They are adjusted for cost-of-living factors like effective income tax rates, gasoline prices, and other relevant factors. The salary of Financial Consultants varies depending upon the job location and their experience.

The educational requirement for financial consultants varies from one state to another. Senior consultants should have at minimum five years of experience. Around half of senior consultants in financial services are employed by them. Around 40% own their own businesses. Senior consultants typically hold undergraduate degrees in finance, business administration, or economics. Compensation depends on the type and number of clients that they serve. In addition, the higher the education level, the higher the salary.

Location

There is a large gap in the average Financial Consultant salary across cities. The average New York City salary is actually $14,030 more than the national average. It is because of the high cost of living that some cities offer higher salaries. Below are five cities that offer more than the average national salary for Financial Consultants. The average income for a financial consultant depends on the place you live in, the industry and your education.

Financial consultants average $95,500 per-year, but their salaries can vary depending on where they are located, their education and experience. The average salary for a financial consultant is $95,500 per year. Senior consultants make between $65,000-70,000 in mid-tier consultancy firms. The average salary for a Financial Consultant may vary by up to $46,000, depending on where they live, the firm they work for, and how long they've been in the field.

Hours of work

You can choose to work as a financial advisor part-time or fulltime depending on your job. This job may require you to travel to clients, and could also require you to work weekends. You may be eligible for health insurance, a pension plan (401(k), retirement plan), paid time off, or commuter benefits. This position requires excellent client service skills, excellent communication skills, and good time management skills. The hours of work for a financial consultant vary greatly, so it's important to choose the job that best suits your schedule and preferences.

Financial consultants are usually highly experienced in the field of finance. To be a successful financial consultant, you need a strong portfolio and an impressive track record. A financial consultant needs to be knowledgeable about current economic trends. They also need to have a clean record. Start networking to build a strong network and find a job in financial consulting. Once you have a good reputation, you should be able to find clients quickly. Although the hours required to work as a financial consultant are flexible, they typically work between thirty-five and sixty five hours per week.

FAQ

What is the difference in a consultant and advisor?

A consultant provides advice on a topic. A consultant can offer solutions.

To help clients achieve their goals, a consultant works directly with them. The advisor provides indirect advice through books, magazines lectures, seminars, and the like.

Are you a consultant?

Consulting is not only an entry-level profession for those looking to make fast money, but it's also an excellent way to acquire valuable skills that you can apply throughout your career.

Consulting can offer many career opportunities, such as project management and business development. You might find yourself working on projects ranging from small start-ups to large-scale international corporations.

Consulting allows you to learn and improve your skills while also gaining experience in many industries. This could include learning how to manage teams, write proposals, manage budgets and analyze data.

How much should you charge as a consultant?

It depends on what you are offering. It doesn't matter if you offer services at no cost. If you sell products or services, however, you must set prices based upon value.

If you are offering low-quality services, you don't have much to sell. So why would anyone pay you anything?

If you provide high-quality service, you may ask for higher prices because people appreciate the value you offer. You may also want to offer discounts to clients who buy multiple packages from you.

Statistics

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

External Links

How To

How To Find The Best Consultant?

It is important to first ask yourself what you expect from a consultant when searching for one. Before you begin looking for a consultant, it is important to know what your expectations are. You should make a list of all the things you need from a consultant. This list could include technical expertise, project management skills, communication skills and availability. Once you have identified your requirements, you might consider asking friends and colleagues to recommend you. Ask them what their experience with consultants was like and how they compare to yours. Research online if you don’t already have recommendations. There are many websites that allow users to leave feedback about their previous work experiences, such as LinkedIn and Facebook, Angie's List or Indeed. Look at the ratings and comments left by others and use this data as a starting point for finding potential candidates. Once you have a shortlist, be sure to contact potential candidates directly to schedule an interview. You should discuss your requirements with the candidates and ask them how they can help. It doesn't matter whether they were recommended to you or not; just ensure that they understand your business objectives and can demonstrate how they can help you reach those goals.